irs unemployment tax refund status tracker

TurboTax cannot track or predict when it will be sent. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

While you would need to amend your tax return under normal circumstances the IRS introduced a law that.

. Any updates on how to track the IRS unemployment tax refund. All of the federal taxes withheld will be reported on the 2021 return as a tax payment. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

They fully paid and paid their state unemployment taxes on time. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. This is available under View Tax Records then click the Get Transcript button and choose the.

If you claim unemployment and qualify for. Will display the status of your refund usually on the most recent tax year refund we have on file for you. Since May the IRS has been.

Direct deposit refunds started going out Wednesday and paper checks today. Why did I get a second tax refund. Using the IRS Wheres My Refund tool.

And the IRS can only hire and train so many people so fast to handle the extra load even if they had enough. 2 days agoAfter entering your information the tool will provide you with one of three statuses. Ad Learn How Long It Could Take Your 2021 Tax Refund.

How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Click on TSC-IND to reach the Welcome Page.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. Another way is to check your tax transcript if you have an online account with the IRS.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. September 20 2021 511 PM. Viewing your IRS account information.

IR-2021-159 July 28 2021 The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. Among those tax returns are people who paid taxes on unemployment compensation when they were out of work.

Thursday April 21 2022. See How Long It Could Take Your 2021 Tax Refund. Enter the whole dollar amount of the refund you requested.

TAX SEASON 2021. IRS unemployment refund update. Visit IRSgov and log in to your.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. Select Check the Status of Your Refund found on the left side of the Welcome Page. Sadly you cant track the cash in the way.

Make sure its been at least 24 hours before you start tracking your refund or up to four weeks if you mailed your return. 402K Likes 14K Comments. Check For the Latest Updates and Resources Throughout The Tax Season.

Exclusion for Tax Year 2020 Only. Check My Refund Status. Refunds Interest Unemployment Refunds taxtok taxnews taxes tax.

Taxpayers can start checking the status of their refund using Wheres My Refund within 24 hours after e-filing the tax year 2021 return three or four days after e. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR.

TurboTax cannot track or predict when it will be sent. 22 2022 Published 742 am. Go to the Get Refund Status page on.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. By Anuradha Garg. 4 weeks after you mailed your return.

The IRS says that you can also use the online tool to check the status of your tax refund within. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. The IRS unemployment tax refund recalls the incident of returning the taxes that were given over the unemployment benefits.

The Internal Revenue Service and the Department of Treasury started sending out unemployment refunds to taxpayers who didnt claim their rightful unemployment compensation on their federal income tax returns. By law the IRS has to pay you interest when it sends you your refund 45 days after the filing deadline which is April 15 2021 for tax year 2020 Phase I Unemployment refunds. Heres how to check online.

Unemployment tax refund status. 24 hours after e-filing. Refund for unemployment tax break.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for. Online Account allows you to securely access more information about your individual account.

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Three or four days after e-filing a tax return. There is no way to track this since the department who has been tasked with this and all the other unusual situations this year are overwhelmed by millions of returns in a department only set up to process thousands of returns per year.

TikTok video from Tax Professional EA dukelovestaxes. The Department of Labor has not designated their state as a credit. To report unemployment compensation on your 2021 tax return.

For this round the average refund is 1686. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive. The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Stimulus Check Status Update Irs Payment Timeline What To Know About Plus Up Money Irs Tax Refund Filing Taxes

How To Find Your Irs Tax Refund Status H R Block Newsroom

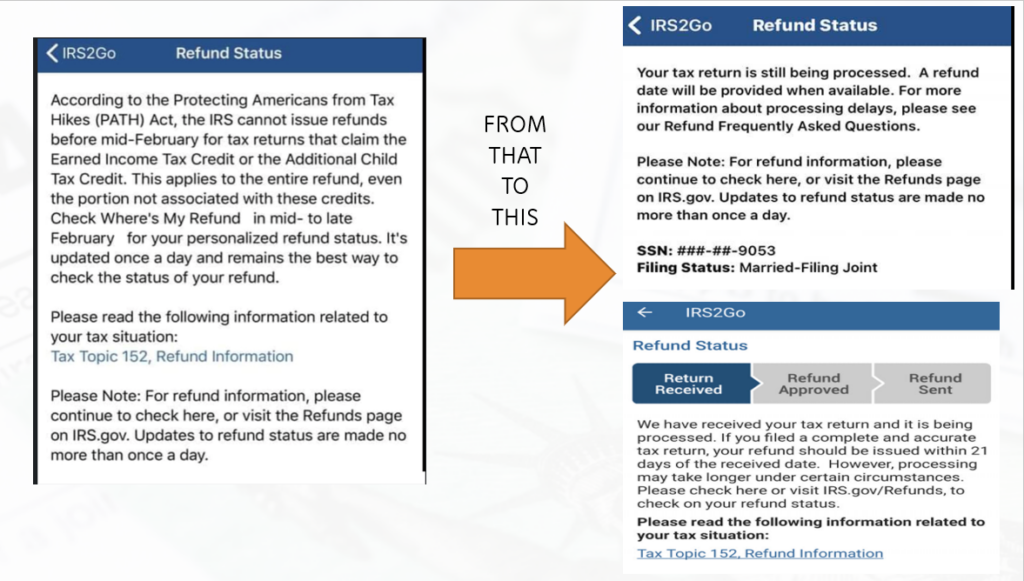

Tax Refund Status Is Still Being Processed

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

How To Track Your Tax Refund S Whereabouts Cbs News

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Refund Timeline Here S When To Expect Yours

Tax Return Delays Irs Holds 29 Million Returns For Manual Processing

Irs Tax Refund Delays Persist For Months For Some Americans Abc11 Raleigh Durham

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Tax Refund Irs The Motley Fool

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Timeline Here S When To Expect Yours

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment In 2021 Tax Refund Irs Taxes Checks